Penn 1 Office Sublease Guide from $40.00 SF

Photo courtesy Costar, the Leading Provider of RE Data

Penn 1 Office Sublease Guide from $40.00 SF reports on high quality occupied work spaces that are now listed for sublease due to the impacts of the Covid-19 pandemic. For forward looking firms, a return to a central office (post vaccine) is inevitable. At this moment in the real estate cycle exceptional values can be secured by subleasing a discounted fully furnished office.

Use this link for Cogent Realty’s analysis of Sublease Rewards and Risks.

Working at Penn 1

• Ultra- accessible location at Penn Station minimizes commuting time

• Ultra- accessible location at Penn Station minimizes commuting time

• 695 car underground garage

• Owned and managed by Vornado, a publically traded company

• Class A high quality full service office environment

• 24/7 access, concierge attended lobby and security monitoring

• Telecom providers include Verizon, Cogent, MCI/Verizon Business, Time Warner Telecom, Con Ed, AT&T, Time Warner Cable, Direct TV, Light Tower

Offices for Sublease at Penn 1

In a distressed market like what we are experiencing in 2020, sublease rents are often heavily discounted. According to a recent report in Globe St.com “Class-A asking rents in CBD markets are down by 2.7%, while sublease space is currently leasing at an average 23.9% discount compared to direct lease space, per data from Colliers International. This is above historical discounts for sublease space.”

Remarks about Subleases:

- Sublease rents are negotiable and their pricing strategy is variable. Some subleases are immediately advertised with a discounted rent. Alternatively, a sublease may be advertised with the rent currently paid by the Sub-landlord which sets the starting point for negotiations.

- Where sublease term lengths are shorter than desired, it is often possible to obtain a separate direct lease with the building owner for additional years which are typically at a higher rental rate.

A partial list of sublease offices follows. Call for updated information: (212) 509-4049.

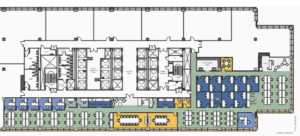

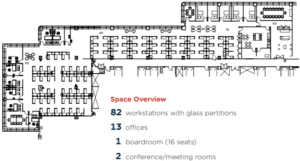

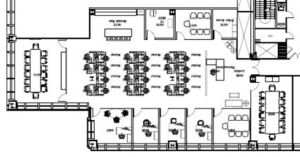

Partial Floor: 7,000 – 19,437 RSF

Full Floor: 37,867 RSF

Panoramic views complemented by a multi-million dollar high-tech turn-key installation. Floor plans and details on request. Asking rent is $40.00.

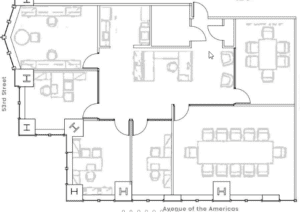

14,394 RSF

Thru 4/2022

Asking $48.00

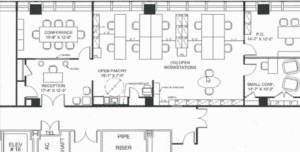

3,345 RSF

Thru 6/22

Call for Rent

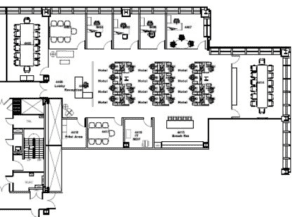

6,858 RSF

Thru 4/2025

Asking $77.00

5,013 RSF

Thru 9/2027

Asking $57.00

5,755 RSF

Thru 4/2024

Asking $56.00

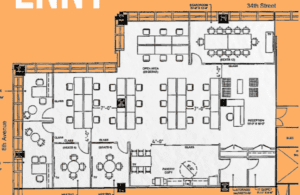

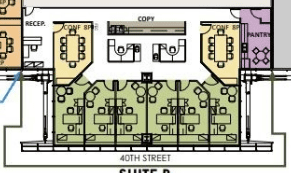

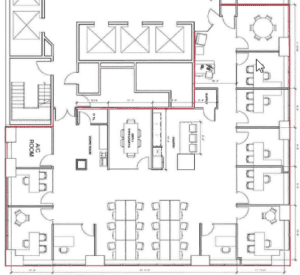

19,517 RSF

Thru 11/2027

Asking $54.00

About Cogent Realty Advisors, Inc.

Cogent Realty Advisors is an independent and licensed no fee Realtor with 20 years of experience representing businesses that lease NYC office space. We offer solutions for office Tenants seeking stability and value in uncertain times. For information phone Mitchell Waldman at (212) 509-4049.

#Penn1OfficeSublease

The post Penn 1 Office Sublease Guide appeared first on Rent NY Office.

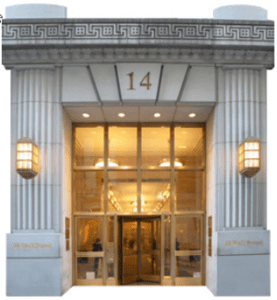

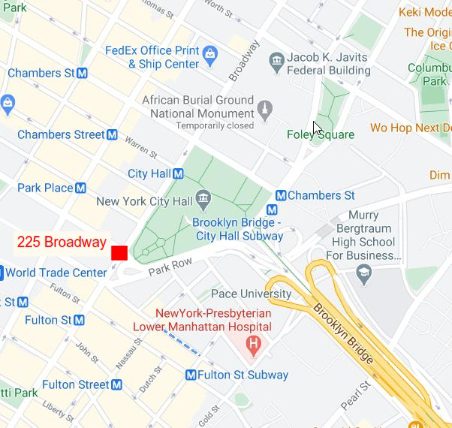

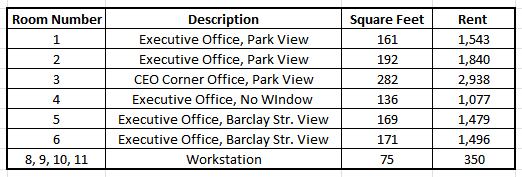

Wall Street Offices from $39.00 SF are ready for immediate lease at 14 Wall Street. In response to steep decline in new leasing activity due to the Covid 19 pandemic, the owner of 14 Wall Street has reduced pricing to attract Tenants. The $39.00 per square foot base rent is limited to specific pre-built office spaces.

Wall Street Offices from $39.00 SF are ready for immediate lease at 14 Wall Street. In response to steep decline in new leasing activity due to the Covid 19 pandemic, the owner of 14 Wall Street has reduced pricing to attract Tenants. The $39.00 per square foot base rent is limited to specific pre-built office spaces.

Manhattan Office Rental Market, Fall 2020 remains in limbo. The volume of leases being executed for new offices is at its lowest point since 9/11. There is deep uncertainty about whether employees can return to work safely- even after modifications are made to transportation systems, building common areas and private work spaces. Alternatively, the long-term viability of the Work From Home (WFH) strategy remains unknown.

Manhattan Office Rental Market, Fall 2020 remains in limbo. The volume of leases being executed for new offices is at its lowest point since 9/11. There is deep uncertainty about whether employees can return to work safely- even after modifications are made to transportation systems, building common areas and private work spaces. Alternatively, the long-term viability of the Work From Home (WFH) strategy remains unknown. CoStar

CoStar

How the Pandemic Has Impacted Commercial Real Estate: Mary Ann Tighe, CBRE New York Tri-State Region chief executive officer, discusses the state of commercial real estate in New York since the coronavirus pandemic. She speaks with Bloomberg’s David Westin on “Bloomberg: Balance of Power.” (Source: Bloomberg)

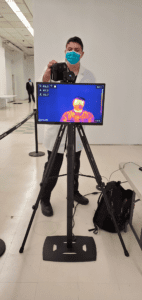

How the Pandemic Has Impacted Commercial Real Estate: Mary Ann Tighe, CBRE New York Tri-State Region chief executive officer, discusses the state of commercial real estate in New York since the coronavirus pandemic. She speaks with Bloomberg’s David Westin on “Bloomberg: Balance of Power.” (Source: Bloomberg)  Office Landlords Hire Hygienists, Scientists and ‘Ambassadors’ to Try to Check COVID-19 at the Door: Reopening Puts Workplace Habits, Office Staff Under the Microscope

Office Landlords Hire Hygienists, Scientists and ‘Ambassadors’ to Try to Check COVID-19 at the Door: Reopening Puts Workplace Habits, Office Staff Under the Microscope  Return to office will be much slower than expected, survey says.

Return to office will be much slower than expected, survey says.