Manhattan Office Rental Market Report, Q1 2021

Manhattan Office Rental Market Report, Q1 2021. A year has past since the pandemic began and its dramatic impact on the office market is apparent. The closure of essential businesses contributed to a migration of residents away from the city. Office occupancy in New York is now hovering around 20%, among the lowest in the nation. Many companies learned to operate virtually and their work-from-home strategy proved to be productive and cost-effective.

Manhattan Office Rental Market Report, Q1 2021. A year has past since the pandemic began and its dramatic impact on the office market is apparent. The closure of essential businesses contributed to a migration of residents away from the city. Office occupancy in New York is now hovering around 20%, among the lowest in the nation. Many companies learned to operate virtually and their work-from-home strategy proved to be productive and cost-effective.

Commercial real estate owners and private employers are optimistic that the deployment of Covid 19 vaccines will encourage more workers to return to the office voluntarily. In anticipation of this trend transportation providers, buildings and office occupiers themselves have implemented sanitary protocols to minimize exposure to the virus. In an effort to reduce workplace headcounts many companies are using a hybrid work model that divides an employees’ work week between the office and home. It is likely that that the long-term impact of this model will result in an overall reduced demand for space.

Remote Work Is Here to Stay. Manhattan May Never Be the Same.

![]()

Growing Number of Companies Plan to Shrink Office Space, Survey Finds

Construction at the 2.85M SF Spiral at 66 Hudson Boulevard in Hudson Yards, Manhattan

There are more than 21 million-SF of office development projects under construction at this time. Additionally, well capitalized owners of existing buildings are undertaking expensive repositioning (renovations) of certain assets to attract new Tenants. Although vacancy levels will be elevated in the coming years, developers are optimistic that future leasing activity will occur in the newest and highest quality buildings.

The Rudin Family to Reposition 3 Times Square

The Rudin Family to Reposition 3 Times Square

In the current Tenant-friendly environment asking rents are being discounted and incentives like rent abatements are increasing. Many Landlords are offering more flexible terms with shorter duration leases.

Office landlords offer discounts to lock in leases

Office landlords offer discounts to lock in leases

Costar’s Analysis of the Manhattan Office Rental Market

CoStar is the world leader in commercial real estate information and has the most comprehensive database of real estate data throughout the US, Canada, UK, France, Germany and Spain.

is the world leader in commercial real estate information and has the most comprehensive database of real estate data throughout the US, Canada, UK, France, Germany and Spain.

Key Costar Manhattan Office Indicators:

- Vacancy Rate: 11.3% ↑

- Market Rent: $57.52* ↓ (The rental income that a property would most probably command in the open market. This is the weighted average across all Manhattan office buildings.)

- Under Construction: 21,889,096 SF

- Total Rentable Building Area: 949,560,537 SF

Projections

The CRE Brokerage community is projecting Effective Rents* may be reduced 15%-20% from the peak recorded in 2019. This is consistent with the rent adjustments that occurred after 9/11. Substantial rent discounts may occur in lower quality Class B and C buildings. Trophy and Class A buildings that currently have a minimal amount of vacancy and a stable Tenant roster are unlikely to offer significant discounts on their rent.

*Effective Rents: The average rent paid over the term by a tenant adjusted downward for concessions paid for by the landlord (such as free rent, moving expenses, or other allowances), and upward for costs that are the responsibility of the tenant (such as operating expense pass through).

Office occupiers that are flexible in regards to their lease term and space design will secure the deepest rental discount with a Sublease. Refer to our recent report Sublease Risk & Rewards in 2020.

Vacant sublet space in New York’s office market is up 91% since mid-2019

Vacant sublet space in New York’s office market is up 91% since mid-2019

About Cogent Realty Advisors, Inc.

Cogent Realty Advisors is an independent and licensed no fee Realtor with 20 years of experience representing businesses that lease NYC office space. We offer solutions for office Tenants seeking stability and value in uncertain times. For information phone Mitchell Waldman at (212) 509-4049.

#ManhattanOfficeQ12021

The post Manhattan Office Rental Market Report, Q1 2021 appeared first on Rent NY Office.

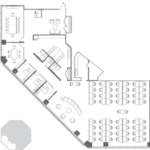

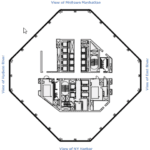

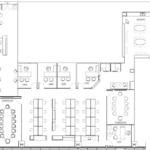

#1: Pre-built move-in ready office space with elegant finishes.

#1: Pre-built move-in ready office space with elegant finishes.

Manhattan Office Rental Market, Year End 2020.

Manhattan Office Rental Market, Year End 2020.