NYC Office Rental Market, the Pandemic and Future

The pandemic is having a profound effect on society, health and the economy of New York City. The long term impact on the NYC office rental market remains unknown in spite of countless predictions (often contradicting) from industry-related spokespersons including economists, building owners, brokers, architects, etc.

The pandemic is having a profound effect on society, health and the economy of New York City. The long term impact on the NYC office rental market remains unknown in spite of countless predictions (often contradicting) from industry-related spokespersons including economists, building owners, brokers, architects, etc.

Our common-sense evaluation of the NYC Office Rental Market concludes the following:

The pandemic will result in a more favorable office rental market for Tenants.

The pandemic will result in a more favorable office rental market for Tenants.

Building Owners will be by forced to revise their economic model (expectations) to secure new leases and renewal leases.

Building Owners will be by forced to revise their economic model (expectations) to secure new leases and renewal leases.

In the near future the office market will offer: (1) increased availability of space; (2) reductions in asking rents and negotiated contract rents; and (3) increases in leasing incentives provided by Landlords such as free rent and cash contributions for the renovation of an office.

In the near future the office market will offer: (1) increased availability of space; (2) reductions in asking rents and negotiated contract rents; and (3) increases in leasing incentives provided by Landlords such as free rent and cash contributions for the renovation of an office.

The magnitude of the changes in the office market will be contingent upon the duration of the pandemic and New York State’s “pause”.

The magnitude of the changes in the office market will be contingent upon the duration of the pandemic and New York State’s “pause”.

Other pandemic-related factors influencing the overall NYC office market include: (1) the success of the corporate directed full- and part-time work from home strategy; (2 ) the reduction in office headcount density to meet the requirement of social distancing; (3) whether decentralizing office occupancy by relocating employees to suburban locations gains traction; and (4) the survival of coworking operators like WeWork which collectively occupy almost 3.0 % of all of the space in the city.

Other pandemic-related factors influencing the overall NYC office market include: (1) the success of the corporate directed full- and part-time work from home strategy; (2 ) the reduction in office headcount density to meet the requirement of social distancing; (3) whether decentralizing office occupancy by relocating employees to suburban locations gains traction; and (4) the survival of coworking operators like WeWork which collectively occupy almost 3.0 % of all of the space in the city.

NYC Office Rental Data

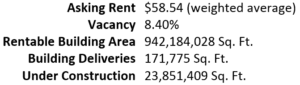

CoStar, the world leader in commercial real estate information reports the following New York City (Manhattan only) office market indicators on May 15, 2020:

Projections for Future Leasing

CoStar states: “While no clear signs of the effects of the pandemic are evident after two months, it is clear what will be affected due to the shutdown of all non-essential businesses. With building tours canceled and large firms tackling the pandemic across their global office portfolio, leasing activity will surely be impacted into the third quarter of 2020 at the very least. Vacancies are sure to rise if deliveries for certain projects deliver on or close to schedule, which is likely the case as projects are slated to resume activity sometime in June. With more than 23 million-SF of projects under construction, it is not the best time for the city to witness a demand shortage. Fortunately for developers, tenant demand should still center around the best product while vintage assets may deal with spaces sitting on the market for an extended period of time. ”

Class A Meet Plan B: How the Coronavirus Could Impact NYC’s Newly Built Office Space

Class A Meet Plan B: How the Coronavirus Could Impact NYC’s Newly Built Office Space

Moody’s Analytics Predicts 20% NYC Office Rent Drop In 2020

Moody’s Analytics Predicts 20% NYC Office Rent Drop In 2020

Commercial Landlords are Feeling the Pain

Commercial Landlords are having difficulty collecting rent.

SL Green cuts guidance with virus hampering city rent collection

SL Green cuts guidance with virus hampering city rent collection

Steve Roth: ‘Life Is Upside Down’ As Vornado Furloughs 1,800, Loses Millions In Revenue

Steve Roth: ‘Life Is Upside Down’ As Vornado Furloughs 1,800, Loses Millions In Revenue

ESRT ‘Will Aggressively Pursue’ Rent Collection From Tenants Who Can Pay

ESRT ‘Will Aggressively Pursue’ Rent Collection From Tenants Who Can Pay

Landlords call for property tax strike

Landlords call for property tax strike

Landlord-Tenant Issues

Commercial Landlord-Tenant Issues During The Pandemic

Commercial Landlord-Tenant Issues During The Pandemic

Landlords ‘Taken Aback’ As Starbucks Requests Yearlong Rent Concessions

Landlords ‘Taken Aback’ As Starbucks Requests Yearlong Rent Concessions

A WeWork Agreement is Not a Lease, and Why This Matters Now

A WeWork Agreement is Not a Lease, and Why This Matters Now

Companies Pause and Re-evaluate

Around the world, companies have been shown both the limits and benefits of keeping workers in their homes. BISNOW May 18, 2020 reported: “By the end of April, 69% of companies had plans to shrink their office footprint in accordance with increased remote work, according to a CoreNet Global survey. Similarly, a survey of over 300 chief financial officers by Gartner, an S&P 500 research and advisory company, found that 74% of companies intend to shift at least 5% of their workforces to remote work. For most of those companies, at least 10% or 20% of workers are expected to remain remote.”

Twitter to Let Employees Work From Home Permanently

Twitter to Let Employees Work From Home Permanently

Seeking Opportunity In a Time of Crisis

Loaded with cash, real estate buyers wait for sellers to crack

Loaded with cash, real estate buyers wait for sellers to crack

Published by Cogent Realty Advisors

Cogent Realty Advisors is an independent and licensed NO FEE Realtor with 20 years of experience representing businesses that lease NYC office space. Our goal is to help you find the right office at the right price. For information, phone Mitchell Waldman at (212) 509-4049.

#NYCOfficeRentalPandemic

The post NYC Office Rental Market, the Pandemic and Future appeared first on Rent NY Office.

Office Space Price Guide for Buildings near Penn Station, 2020 provides useful information for any business that leases space.

Office Space Price Guide for Buildings near Penn Station, 2020 provides useful information for any business that leases space.

450 SEVENTH AVENUE is located at the north west corner of 34th Street, about 100 feet from the entrance to Penn Station. It contains 520,000 RSF of Class B office space spread over 46 floors. It is well maintained and owner-occupied. 450 Seventh Avenue just completed renovations of its lobby, elevators, corridors and bathrooms. The building is primarily occupied by small- and mid-size firms including law, accounting, insurance and technology. The current vacancy rate is 3.3% and asking rents cost from $58.00- $62.00 PSF. The Landlord is able to custom-build your office quickly.

450 SEVENTH AVENUE is located at the north west corner of 34th Street, about 100 feet from the entrance to Penn Station. It contains 520,000 RSF of Class B office space spread over 46 floors. It is well maintained and owner-occupied. 450 Seventh Avenue just completed renovations of its lobby, elevators, corridors and bathrooms. The building is primarily occupied by small- and mid-size firms including law, accounting, insurance and technology. The current vacancy rate is 3.3% and asking rents cost from $58.00- $62.00 PSF. The Landlord is able to custom-build your office quickly.

463 SEVENTH AVENUE is located at the north west corner of 35th Street, across from Macys. True to its fashion roots, this high quality building is home to a significant number of apparel companies. Other Tenants include offices for New York Presbyterian Hospital, management consulting and real estate investment. The building provides 24/7 access, a new lobby with uniform concierge, destination dispatch elevators, Tenant-controlled air conditioning, renovated corridors and rest rooms. Asking rents are priced from $49.00 to $55.00 PSF. On lease terms of five or more years the Landlord will custom build your office.

463 SEVENTH AVENUE is located at the north west corner of 35th Street, across from Macys. True to its fashion roots, this high quality building is home to a significant number of apparel companies. Other Tenants include offices for New York Presbyterian Hospital, management consulting and real estate investment. The building provides 24/7 access, a new lobby with uniform concierge, destination dispatch elevators, Tenant-controlled air conditioning, renovated corridors and rest rooms. Asking rents are priced from $49.00 to $55.00 PSF. On lease terms of five or more years the Landlord will custom build your office.

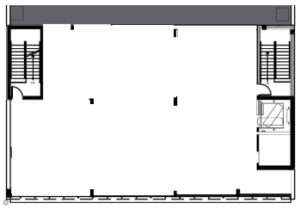

7 PENN PLAZA aka 370 Seventh Avenue, is a pristine owner-occupied and managed office building spanning the entire block front from 31st to 30th Street. This 18 floor building features windows on four sides, 24/7 access, a handsomely renovated concierge attended lobby and central HVAC. It is popular with small and mid-size firms such as legal services, accounting, architecture/engineering, software and financial advisors. Stores at the base of the building include Starbucks, the Juice Shop, Sweetgreen and coming soon- Sticky’s Finger Joint. Contemporary turn-key offices and build-to-suit spaces are available with asking rents from $70.00 PSF.

7 PENN PLAZA aka 370 Seventh Avenue, is a pristine owner-occupied and managed office building spanning the entire block front from 31st to 30th Street. This 18 floor building features windows on four sides, 24/7 access, a handsomely renovated concierge attended lobby and central HVAC. It is popular with small and mid-size firms such as legal services, accounting, architecture/engineering, software and financial advisors. Stores at the base of the building include Starbucks, the Juice Shop, Sweetgreen and coming soon- Sticky’s Finger Joint. Contemporary turn-key offices and build-to-suit spaces are available with asking rents from $70.00 PSF.

225 WEST 34TH STREET aka 14 Penn Plaza is located mid-way between Seventh and Eighth Avenue. This large Art Deco style building (1925) has an architecturally restored lobby coupled with modern building systems. Amenities include 24/7 access and an attended lobby, Tenant-controlled air conditioning, office cleaning and a choice of seven high-speed telecom providers. Currently it is 96% rented. Vacant spaces ranging in size from 996 to 8,430 RSF are now available for the lease. The cost of asking rents starts at $65.00 PSF.

225 WEST 34TH STREET aka 14 Penn Plaza is located mid-way between Seventh and Eighth Avenue. This large Art Deco style building (1925) has an architecturally restored lobby coupled with modern building systems. Amenities include 24/7 access and an attended lobby, Tenant-controlled air conditioning, office cleaning and a choice of seven high-speed telecom providers. Currently it is 96% rented. Vacant spaces ranging in size from 996 to 8,430 RSF are now available for the lease. The cost of asking rents starts at $65.00 PSF.

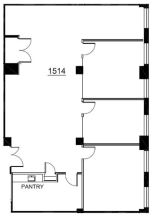

505 EIGHTH AVENUE is located at the north west corner of 35th Street. This boutique loft building has 11,000 RSF floors which in some instances have been heavily divided for a diverse group of Tenants occupying offices as small as 500 RSF. Amenities include 24/7 access, an attended lobby during business hours and Tenant-controlled AC. Asking rents cost $48.00 PSF and the Landlord will build-to-suit.

505 EIGHTH AVENUE is located at the north west corner of 35th Street. This boutique loft building has 11,000 RSF floors which in some instances have been heavily divided for a diverse group of Tenants occupying offices as small as 500 RSF. Amenities include 24/7 access, an attended lobby during business hours and Tenant-controlled AC. Asking rents cost $48.00 PSF and the Landlord will build-to-suit.

237 WEST 35TH STREET is located between Seventh and Eighth Avenue and representative of many of the areas’ loft buildings. Previously rented to garment manufacturing operations, they are now occupied by service professionals (such as law, accounting and architecture) and TAMI (technology, advertising, media and internet) firms. Lower cost rent and an edgy environment are their biggest attraction. To varying degrees the lobby and infrastructure of these buildings has been renovated for “office users”. The office interiors typically have concrete floors, high open ceilings, large windows and quite often, window air conditioning units. At 237 West 35th Street asking rents are $40.00- $44.00 PSF. Additional loft charges include water, sprinkler and rubbish removal.

237 WEST 35TH STREET is located between Seventh and Eighth Avenue and representative of many of the areas’ loft buildings. Previously rented to garment manufacturing operations, they are now occupied by service professionals (such as law, accounting and architecture) and TAMI (technology, advertising, media and internet) firms. Lower cost rent and an edgy environment are their biggest attraction. To varying degrees the lobby and infrastructure of these buildings has been renovated for “office users”. The office interiors typically have concrete floors, high open ceilings, large windows and quite often, window air conditioning units. At 237 West 35th Street asking rents are $40.00- $44.00 PSF. Additional loft charges include water, sprinkler and rubbish removal. Office Renters Report for Buildings Near

Office Renters Report for Buildings Near

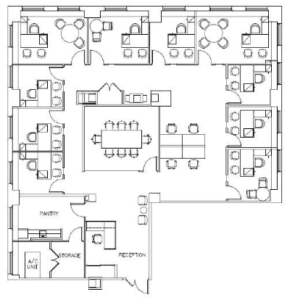

122 EAST 42ND STREET aka The Chanin Building, is located at the south east corner of Lexington Avenue. This Art Deco gem provides access to the terminal through an underground passage way. As a corner building its upper floors are blessed with excellent light and views. Many of the vacant offices are 2nd generation (i.e. previously occupied) where the Landlord will provide cosmetic upgrades only. Building amenities include 24/7 access with uniformed lobby attendants and security personnel, central HVAC, office cleaning and varied selection of onsite quick service restaurants. Asking rents are from $53.00- $68.00 PSF.

122 EAST 42ND STREET aka The Chanin Building, is located at the south east corner of Lexington Avenue. This Art Deco gem provides access to the terminal through an underground passage way. As a corner building its upper floors are blessed with excellent light and views. Many of the vacant offices are 2nd generation (i.e. previously occupied) where the Landlord will provide cosmetic upgrades only. Building amenities include 24/7 access with uniformed lobby attendants and security personnel, central HVAC, office cleaning and varied selection of onsite quick service restaurants. Asking rents are from $53.00- $68.00 PSF.

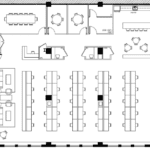

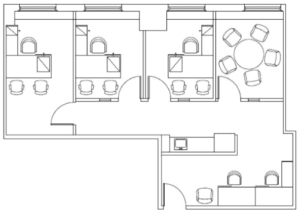

370 LEXINGTON AVENUE is one of the top values in the area. Located at the south west corner of 41st Street, this Class A building features 24/7 access, a concierge attended lobby, central HVAC and office cleaning. Popular onsite restaurants include Maison Kayser, Omusubi Gonbei and Zucker’s Bagels. 370 Lexington is ideal for small- and mid- size firms and sleek newly constructed offices, two Tenant-only conference centers and flexible lease terms as short as 3 years. Asking rents are $62.00- $66.00 PSF.

370 LEXINGTON AVENUE is one of the top values in the area. Located at the south west corner of 41st Street, this Class A building features 24/7 access, a concierge attended lobby, central HVAC and office cleaning. Popular onsite restaurants include Maison Kayser, Omusubi Gonbei and Zucker’s Bagels. 370 Lexington is ideal for small- and mid- size firms and sleek newly constructed offices, two Tenant-only conference centers and flexible lease terms as short as 3 years. Asking rents are $62.00- $66.00 PSF.

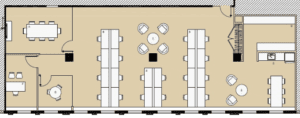

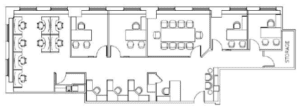

10 GRAND CENTRAL is situated at the north west corner of 44th Street and Third Avenue. A recently completed $45M redevelopment has transformed what was known as 708 Third Avenue into a modern corporate HQ’s building. Included are a stunning lobby and a Tenant Amenity Center featuring a board room, entertainment lounge and landscape terrace. Elegant pre-built and custom built (build to suit) offices are available with asking rents of $84.00 PSF.

10 GRAND CENTRAL is situated at the north west corner of 44th Street and Third Avenue. A recently completed $45M redevelopment has transformed what was known as 708 Third Avenue into a modern corporate HQ’s building. Included are a stunning lobby and a Tenant Amenity Center featuring a board room, entertainment lounge and landscape terrace. Elegant pre-built and custom built (build to suit) offices are available with asking rents of $84.00 PSF.