Wall Street Offices from $39.00 SF

Wall Street Offices from $39.00 SF are ready for immediate lease at 14 Wall Street. In response to steep decline in new leasing activity due to the Covid 19 pandemic, the owner of 14 Wall Street has reduced pricing to attract Tenants. The $39.00 per square foot base rent is limited to specific pre-built office spaces.

Wall Street Offices from $39.00 SF are ready for immediate lease at 14 Wall Street. In response to steep decline in new leasing activity due to the Covid 19 pandemic, the owner of 14 Wall Street has reduced pricing to attract Tenants. The $39.00 per square foot base rent is limited to specific pre-built office spaces.

About 14 Wall Street

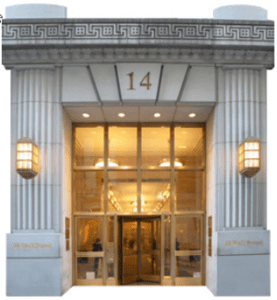

Entrance is opposite NYSE

• Class A office building (1912), NYC Landmark

• Extensively renovated and modernized

• 1,049,292 square feet, 37 floors and 32 elevators

• 24/7/365 access and attended lobby

• Full service includes HVAC and office cleaning

• Multiple telephone and high-speed internet providers

• Diverse Tenant mix includes Amerigroup, Barclays, F.J. Sciame, NYU Medical Center, Skidmore, Owings + Merrill and The Street.

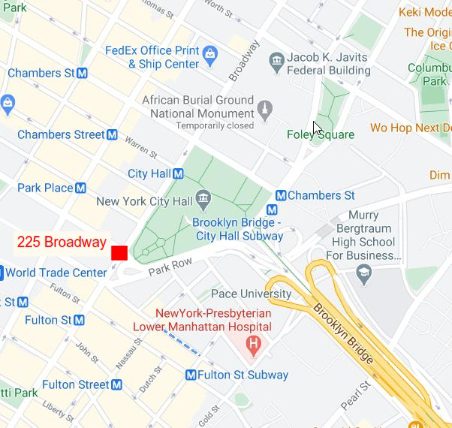

• Within 2 blocks of the 1, 2, 3, 4, 5, A, C, E, J, M, R, W & Z subway and a short walk to the PATH and Staten Island Ferry

Elegant renovated lobby

• Leases signed in this building may qualify for the Lower Manhattan Commercial Revitalization Plan which gives Tenants a $10.00 per square foot rent credit amortized over a 5 year term.

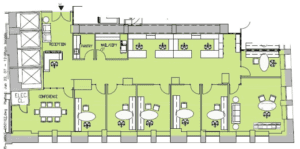

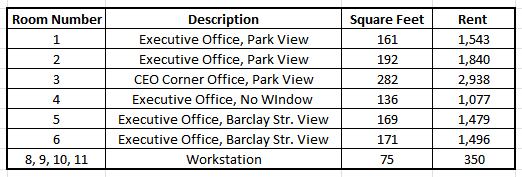

Sample Wall Street Offices from $39.00 Square Foot

For a limited time pre-built offices ranging in size from 1,848 to 5,820 square feet and priced from $39.00 PSF are available. Most of these units are found on the lower floors of the building. For example, the 5,432 RSF office below features a reception area with adjacent conference room, a corner CEO office plus 6 standard windowed offices, area for workstations and a wet pantry. It is designed for a law firm, sales company or sales-oriented business. This unit overlooks Wall Street, Nassau Street and Federal Hall.

5,423 RSF Pre-built Office

14 Wall Street has a broad selection of offices for rent on its tower floors. Some of these units are existing high-end installations and others are “raw space” that the Landlord will custom-build to your specifications. Pricing ranges from $45.00 to $53.00 PSF.

About Cogent Realty Advisors, Inc.

Cogent Realty Advisors is an independent and licensed no fee Realtor with 20 years of experience representing businesses that lease NYC office space. We offer solutions for office Tenants seeking stability and value in uncertain times. For information phone Mitchell Waldman at (212) 509-4049.

#WallStreetOfficesFrom$39

The post Wall Street Office from $39.00 SF appeared first on Rent NY Office.

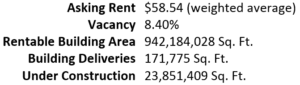

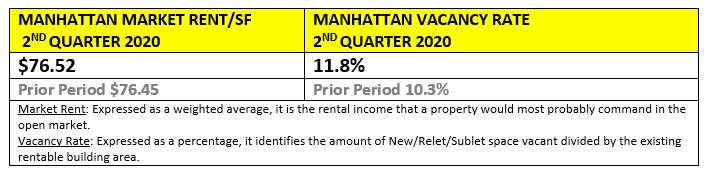

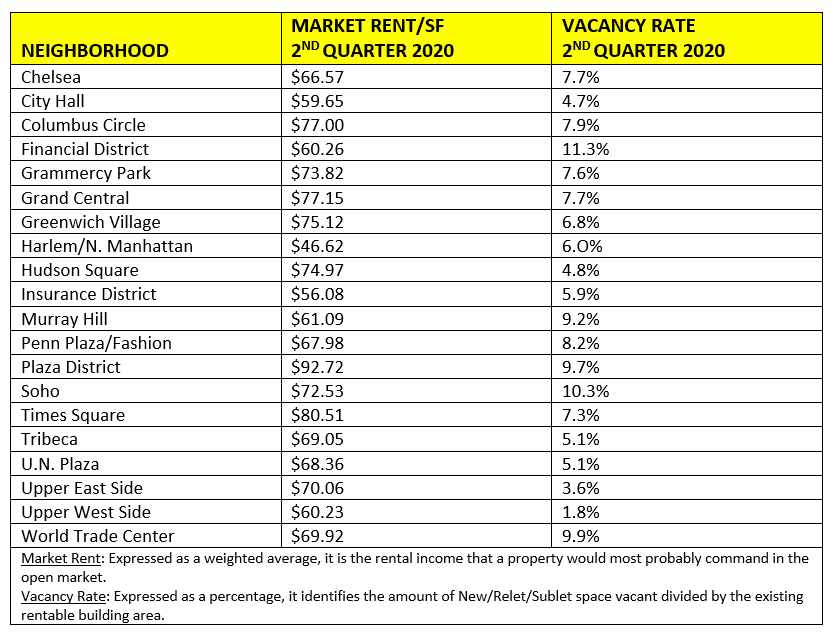

Manhattan Office Rental Market, Fall 2020 remains in limbo. The volume of leases being executed for new offices is at its lowest point since 9/11. There is deep uncertainty about whether employees can return to work safely- even after modifications are made to transportation systems, building common areas and private work spaces. Alternatively, the long-term viability of the Work From Home (WFH) strategy remains unknown.

Manhattan Office Rental Market, Fall 2020 remains in limbo. The volume of leases being executed for new offices is at its lowest point since 9/11. There is deep uncertainty about whether employees can return to work safely- even after modifications are made to transportation systems, building common areas and private work spaces. Alternatively, the long-term viability of the Work From Home (WFH) strategy remains unknown. CoStar

CoStar

How the Pandemic Has Impacted Commercial Real Estate: Mary Ann Tighe, CBRE New York Tri-State Region chief executive officer, discusses the state of commercial real estate in New York since the coronavirus pandemic. She speaks with Bloomberg’s David Westin on “Bloomberg: Balance of Power.” (Source: Bloomberg)

How the Pandemic Has Impacted Commercial Real Estate: Mary Ann Tighe, CBRE New York Tri-State Region chief executive officer, discusses the state of commercial real estate in New York since the coronavirus pandemic. She speaks with Bloomberg’s David Westin on “Bloomberg: Balance of Power.” (Source: Bloomberg)  Office Landlords Hire Hygienists, Scientists and ‘Ambassadors’ to Try to Check COVID-19 at the Door: Reopening Puts Workplace Habits, Office Staff Under the Microscope

Office Landlords Hire Hygienists, Scientists and ‘Ambassadors’ to Try to Check COVID-19 at the Door: Reopening Puts Workplace Habits, Office Staff Under the Microscope  Return to office will be much slower than expected, survey says.

Return to office will be much slower than expected, survey says.

1. Rent is usually below the current market value.

1. Rent is usually below the current market value. New York City Office Rental Report July 2020 is presented by Cogent Realty Advisors, Inc.

New York City Office Rental Report July 2020 is presented by Cogent Realty Advisors, Inc.  The pandemic will result in a more favorable office market for Tenants that execute new leases and renewal leases.

The pandemic will result in a more favorable office market for Tenants that execute new leases and renewal leases.

The pandemic is having a profound effect on society, health and the economy of New York City. The long term impact on the NYC office rental market remains unknown in spite of countless predictions (often contradicting) from industry-related spokespersons including economists, building owners, brokers, architects, etc.

The pandemic is having a profound effect on society, health and the economy of New York City. The long term impact on the NYC office rental market remains unknown in spite of countless predictions (often contradicting) from industry-related spokespersons including economists, building owners, brokers, architects, etc.